Tips from a Travel Banking Advisor

You’ve decided where you’re going and you’re ready, but what do you do to make sure your money is safe and there when you need it? This is a question I get asked often. Every destination is unique, but with the right knowledge and tips, money issues can be a thing of the past while travelling.

Before you Travel there is some Important Tips you need to know on how to get money abroad, dealing with foreign currencies, keeping your money safe and how to avoid those nasty bank fees. Through my years of experience traveling the world here are a few ideas to help you abroad.

Travel with Money

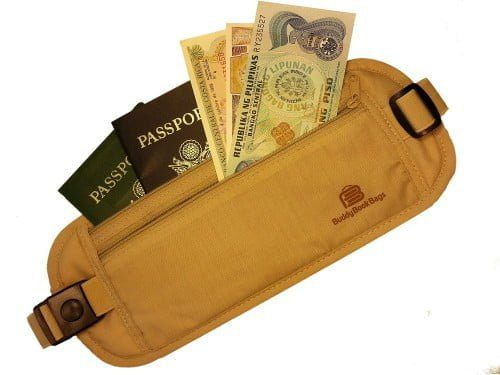

There are pros and cons to this method. First you are putting yourself at risk to be robbed; all it takes is one wrong person to see you pull out a lot of cash and you are their target of the day. When I travel abroad I chose to separate my money. I usually have a money belt as well where I will keep the bulk of my money and I will take it out in a private location. The money I plan to spend for the day is placed in a separate wallet in my side bag.

Bringing Money and How Much

Well this really depends on you. How much cash do you feel safe carrying around? How long are you traveling for? If you are traveling for several weeks or months carrying that much cash is really not the best of ideas. Again you are putting yourself at risk. When I travel I choose to use cash, but I withdraw it from bank machines as needed, there is usually a bank fee for this but really it is a small price to pay for keeping your money safe while you are travelling. When I travel I will usually take out enough cash for a few days that way you are minimizing your bank fees. You may want to check with your bank prior to leaving to find out what kind of banking package you have and what will be covered when you are aboard that way there are no surprises when you find out that most banks charge a fee every time you withdraw cash . These fees are usually applied with most banks as well as credit cards when you use them for a cash advance. All these fees will vary but you can minimize them by how many times you withdraw cash from the bank machine.

Bringing Local Currency

It’s always a good idea to leave home with some of the local currency where you will first be going this way you are not pressured into finding a way to get cash as soon as you get there. You must always keep in mind that there are people out there just waiting for someone who is in need, and a lot of the time they don’t always have your best interests in mind. When you cross the border money changers are waiting and they might charge you twice the exchange rate because you need money. They can be very convincing and you will be amazed at how many “FRIENDS” you have when you are traveling.

Best rule when travelling with cash is take smaller amounts, but withdraw enough for a few days to minimise your fees. I like to use a money belt to keep my stash safe.

Cash, Debit, Credit?

When traveling abroad never rely on only one means of money, it just doesn’t work. When I travel I usually travel with at least 2 to 3 cards. I will have my bank card and 1 or 2 credit cards ( I will very often use my credit card for purchases, as long as you are in a reputable business, this helps to minimize banking fees and cash advance fees). I always keep all three cards in separate locations, for instance one card in my money belt, one card in my theft protection metal case, and one card in my wallet. I only ever use one card on a trip the others will be for backup (you never know when a card will get compromised and fraud detection will freeze it up and then you have no backup.) So just some words of advice keep all your cards in separate locations and try to mainly to use only one card well while traveling. Also by using only one card you are developing a pattern and whether it’s your bank card or your credit card they can see where you are, and how much you are usually withdrawing just a little more protection in case your card gets stolen or compromised.

ATM/ Bank Machines or Merchant Cash Advance

Sometimes you just don’t have a lot of options so try to make the best decision possible. Ask yourself does this cash machine look legit? Do I feel comfortable using a cash machine that is not in my language? Do I know what my daily limit is to withdraw? All of these questions can vary depending where you are. Try to use ATM/bank machines which are in banks or ATM terminals, using a bank machine that is chained to a power pole or in a back alley may not be a very wise choice, it could be legit but not really worth the risk. There is usually always another choice unless you are in a remote area and then you should be pulling out cash in advance just to be safe. Sometimes if you are in a very touristy area the machines tend to run out of cash quick, if you get a weird message like “funds not available” it just usually means the machine is out of cash. Don’t panic, just find another machine and try it, at times I have tried up to 4 machines before getting cash.

Using a Merchant cash advance

This should be used as a very last resort (remember that hand held unit that you put your card in contains all your information from your credit or debit card) Quite often the Merchant will charge you an absorbent fee for the advance on top of the cash advance fees you will already pay with your credit card. In my opinion use a Merchant cash advance as a last resort! If you are looking to make a purchase use your credit card but remember every time you put that card into a machine you are putting yourself at risk.

Travellers Cheques: These are pretty much obsolete most people find that they are difficult to cash and most Merchants will not accept them any longer. There is usually a 1 to 2% fee to purchase them from any financial institute.

Travel with USD: Now depending on where you are traveling a lot of countries will accept US currency. I usually will travel with a small amount of US cash. Most of the time I have found that they want the cash to look new. In order to keep my cash looking new I will use my money holder or take an old cheque book cover and slide a piece of hard card board into it to keep it stiff, slide your cash into it then put it into a ziplock bag and into your money belt. I traveled for several weeks through Myanmar (Burma) keeping my US cash in perfect condition both ways.

Foreign Exchange: This can be very tricky sometimes Money Changers, FX changers, Banks, Merchants all have their own rates. My advice to you here is make sure you know what your dollar is worth in the country that you are traveling to. When you are preparing to leave home check with your bank to see what kind of rate you are going to get for your cash. While you are traveling there are foreign exchange sights available on line , be wise check the rates and know how much your money’s worth, that way you can avoid being a target.

When All Else Fails: You’ve lost your bank card! Where’s your back up? (Right you have that extra card in your money belt) But your credit card has been compromised!!! Go on line and get the credit cards phone number and give them a call they quite often have ways of identifying you and getting your card up and working again. If you have no other cards but you have ID you can in some cases have money wired to you depending on your location. If you are staying in one area for a while quite often a card can be sent via courier. The most important thing is not to panic something can always be figured out.

A good backup plan is to scan your cards (try to use a safe encrypted sight) into the computer as well as your passport and ID and email it to yourself that way you always have access to your important info without carrying everything with you all the time. As long as you have access to your email you have access to your information.

Travel Side Bag

When choosing a side bag to travel with l like to have one with lots of zipper pockets that way I can put my passport in the inside zipper and a small wallet or small amount of cash in another one. I like to keep some small bills for easy access for bathroom tips or taxi tips. The side bag should be made of a heavy materials like canvas or leather. It also should have a main zipper area that is hard to get into and most of all it never comes off me. When I am in a crowded area it hangs in front of me for safety.

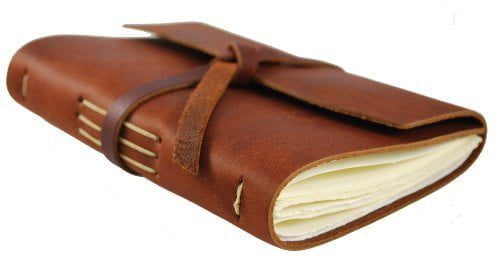

Keeping Log in Travel Journal: While traveling you should carry a Travel Journal, not just to write about your adventures but to also keep track of your budget and when you pull money out. This way if you run into any issues you can look back and know exactly how much you spend and when you made a transaction in case of any bank related errors or attempts from thief’s trying to steal your money.

You should look at setting up someone at home to be your powers of attorney if you are planning to be gone for an extended amount of time. This should be someone that you trust and are very comfortable with. This person can take care of your business for you while you are away. These days you also have online banking which has made our lives so much easier. You can set up automatic bill payments to re-occur as often as needed. You can check bank balances and even check to make sure no one has hijacked your account. Again, you must be careful when accessing this information when abroad, there are culprits lurking around every corner. Your best practice is not to use public Wi-Fi when you’re accessing your personal banking information always try to use a locked site. The banks now have brought out a new app called the wallet in this app you can store your bank cards, credit cards and gift cards, the only problem is quite often these features cannot be used worldwide so exercise caution when relying on some of these features they may not be widely accepted.

And the most important thing of all! Have a wonderful trip and stay safe!

I like the idea to use an ATM that allows you to feel comfortable throughout the transaction. My wife and I are planning on traveling up north and I’m wondering if we’ll have enough cash on hand throughout the trip. Hopefully there will be enough reliable ATM’s available so we can make more transactions and walk with less money on ourselves.

Those are some nice tips on how to save money while traveling to foreign nations. As we can see that many of the people are not even aware of the fact of handling money in other countries. Thank you for giving us good details.

Great such a informative tips you are sharing.. i have enjoy a lot thanks for sharing with us

Thanks for sharing this wonderful blog..

I love to read this wonderful blog. Thanks for share with us.

Very beautiful tips for saving and briefly describe all the main points. Thanks for share